Топик: Industry overview

Industry overview

Scale of the market, its size, total annual sales volume (industry on the whole)

The meat market's capacity is estimated to be 8 million tons, pork’s share is 2.6 million tons (without breaking down the meat into chilled and frozen types). In value terms, the capacity is US$ 15-17 billions. In Russia, average consumption of meat per capita equals 55 kg, 17.8 kg (32%) of which are pork. In terms of meat consumption, Russia lags behind European countries, where a person eats about 80 kg a year. However, due to the general improve of the country’s economy and, consequently, well-being of its citizens, meat consumption in Russia is growing. The growth potential is partially proved by the dynamics of the market volume: the long downfall that lasted throughout 1990s came to an end in 2000-2001, when the market began to grow. In 2002-2005 it gained 20% on the whole, and pork's share has grown 33%.

Market development trends, expected volume

Pork market in Russia tends to grow. Since 1999 its volume has increased over 30%. According to the Rossvinprom’s forecast, by 2010 pork production will rise to 3.3 million t, whereas the total meat market is seen to grow to 10 million t.

Forecasts by the Agrarian Market Research Institute (IKAR) state that during several years ahead the annual growth rate of the domestic pork production will equal about 10%.

As for the meat consumption structure, it is expected to change, affected by the world tendencies and the fact that conditions in Russia are favorable for production of the “fast” types of meat (poultry meat and pork).

In spite of the fact that the pork's share will grow smaller, the market on the whole will gain over 30% in absolute figures.

Seasonal fluctuations of the market

Seasonal factor does not influence the market.

National policy in the sphere of meat market regulation

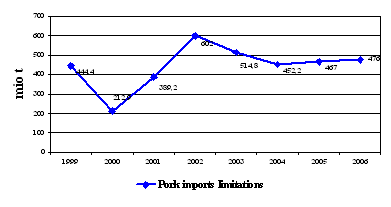

Government of Russia tries to create conditions in which Russian producers can develop. In particular, since 2003 imports of meat in the country are limited. In 2006 the pork import is limited to 476 thousand t. Major pork importers are Brazil, Denmark, USA. Share of chilled meat in the imports is inconsiderable, 90% of the pork is frozen.

|

Fig. 4. Pork imports limitations

Potential capacity of the market. Size of the segment. Annual sales volume (in natural units and in terms of value)

Consumption of meat in the Moscow Region is higher than in other regions (65 kg per capita). Citizens of the Russian capital get about 20% of the actual volume of meat consumed in the country. However, people of the Moscow Region strongly depend on imports of meat. The authorities take actions to weaken this dependency, stimulate development of the local agricultural companies, but the latter prefer not to produce but to deliver goods from other regions. Thanks top them supplies of meat produced in Russia have grown 2.3 fold within the last 4 years. But even with the trend being this positive Russian meat products cover only 61.2% of the market.

In the course of the last 3 years the pork market has grown over a third. The growth is expected to continue for some more years. Moscow’s pork market can be said undersaturated, with the demand for the product growing.

In 2005 the segment witnessed increase of supply from the agricultural companies and food processing enterprises that sell their produce on a retail basis. Share of the smaller private producers of chilled pork has decreased, consequently sales of this type of products on the farmers markets have grown smaller.

Consumers groups

The most active consumers of pork are people aged 30 to 50 years with monthly income over 20 thousand rubles. Target consumers of the chilled pork are citizens of Moscow aged below 50, with monthly income varying from 5 to 10 thousand rubles, and middle-aged consumers earning over 20 thousand rubles per person a month. Commonly, chilled pork is bought by women, but the main consumers are men.

Table 4. Target consumers of chilled and frozen pork

| Consumption of chilled pork, % of the total consumption | |||

| Monthly income, rubles | up to 30 years | 30 to 50 years | over 50 |

| less than 5000 | 2.9 | 7.4 | 4.1 |

| 5000-10000 | 10.8 | 12.3 | 5.2 |

| 10000-15000 | 5.4 | 8.0 | 1.7 |

| 15000-20000 | 2.9 | 5.1 | 1.3 |

| over 20000 | 4.7 | 23.6 | 4.7 |

| Total | 26.7 | 56.4 | 17.0 |

Marketing strategy of the project

__ will use flexible pricing, i.e. the price will depend on the market situation.

Sales stimulation programs

The main target groups are:

Corporate buyers of semi-finished (half-carcass) and finished products (chilled pork):

category managers of retail chains;

product managers of retail chains;

distributors working with independent outlets;

distributors working with HoReCa outlets

directors of smaller retail chains;

directors and chief managers of independent stores;

directors and chief managers of independent HoReCa outlets.

Final buyers of packed and unpacked chilled meat – consumers.

Since the brand is of small importance for the buyers, crucial for the successful sales are:

Level of interest towards the supplier and loyalty, determined by a number of factors:

entry price level and possible extra charge (80%);

range of packed products (10%);

convenient logistics schemes (delivery of minor and medium orders) (10%);

scale of “entry” bonuses (for retail chains).

Level of distribution (as the result of item 1):

interest expressed by owners of the distributing companies;

interest expressed by the sales teams of distributor.

Corporate clients service arrangements:

Group 1. Corporate buyers

Chains

catalogues covering the range of products;

negotiations with chains and reimbursement of the “entry”;

negotiations with chains and reimbursement of the retro bonuses;

participation in the marketing events initiated by the chains (price-related events, special offers, cross-promo);

reimbursement of the products’ merchandizing.

Distributors

catalogues covering the range of products;

flyers;

system of bonuses for plans accomplishments;

shared financing of the marketing events, according to the planned sales;

motivation system, competitions and bonuses awarded to best distributors, trade representatives that attracted the biggest number of customers, made the biggest sales, accomplished all plans etc;

motivation programs developed for directors and chief managers of independent stores and HoReCa outlets.

Group 2. Final buyers

Peculiarity of the chilled and frozen pork market – low awareness buyers have of the producers and brands. This explains relatively low effectiveness of direct influence on buyers.

Among actions taken in the context of working with final buyers are:

merchandising support in retail outlets;

price promotion in retail chains.

Chilled meat produced by the complex under the present project will be priced at 115 rubles per 1 kg (including VAT 10%), which is the same to the wholesale price stated by the Russian companies producing the same goods.

Distribution enjoys support from the marketing policy of the company, including advertising and sales promotion actions.